Case Study

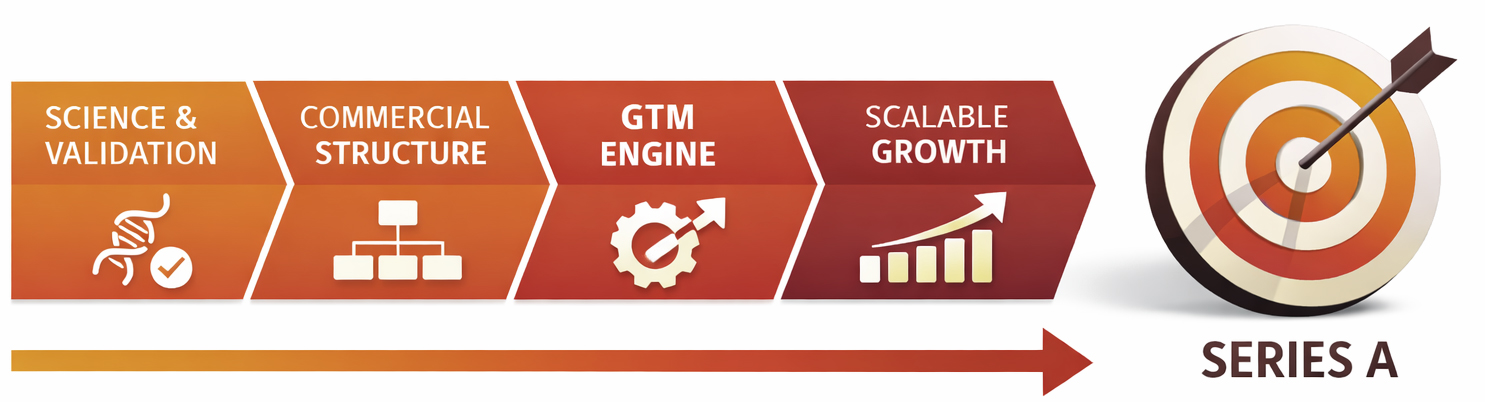

How Thaver Prepared a Life Sciences Company for Series A with Investor-Grade Commercial Structure and GTM Clarity

15 January 2026

Background

A fast-growing life sciences company with strong clinical validation and early customer traction was preparing for its Series A raise.

While investor conversations were active, consistent feedback revealed a familiar issue at this stage: the science was compelling, but commercial execution was immature compared with post–Series A expectations, with inconsistent ownership and intuition-driven decision-making typical of founder-led peers.

Fundraising Context: Why Series A Is About Execution Readiness

At Series A, investors look beyond promise. They expect evidence that growth can be systematically executed and repeated:

Without these, even high-quality life sciences companies struggle to convert interest into conviction.

Key Challenges Before Engaging Thaver

Thaver’s Interim Leadership & Fundraising Readiness Mandate

Thaver was engaged to provide interim commercial and fundraising leadership- embedding ownership, repeatability, and operating discipline inside the business to bridge the gap between scientific credibility and investor-grade execution.

Mandate:

Solution Delivered:

1.

Commercial Structure & Operating Discipline

2.

Go-to-Market Strategy

3.

Series A Growth Roadmap

Results:

Within 90 days

The company entered Series A discussions as a post–Series A–ready business with institutional-grade commercial maturity, not a typical founder-led, intuition-driven opportunity.

Conclusion

At Series A, investors back teams that can clearly demonstrate how growth will be executed reliably, not just why the opportunity exists.

Through embedded interim leadership, Thaver helped this life sciences company achieve post–Series A commercial readiness in just 90 days, building the structure, GTM clarity, and operating discipline that institutional investors expect – turning fundraising conversations into confident, execution-led commitments.