Commercial Due Diligence in Biotech – Why Most Deals Fail Without It

3 February 2026

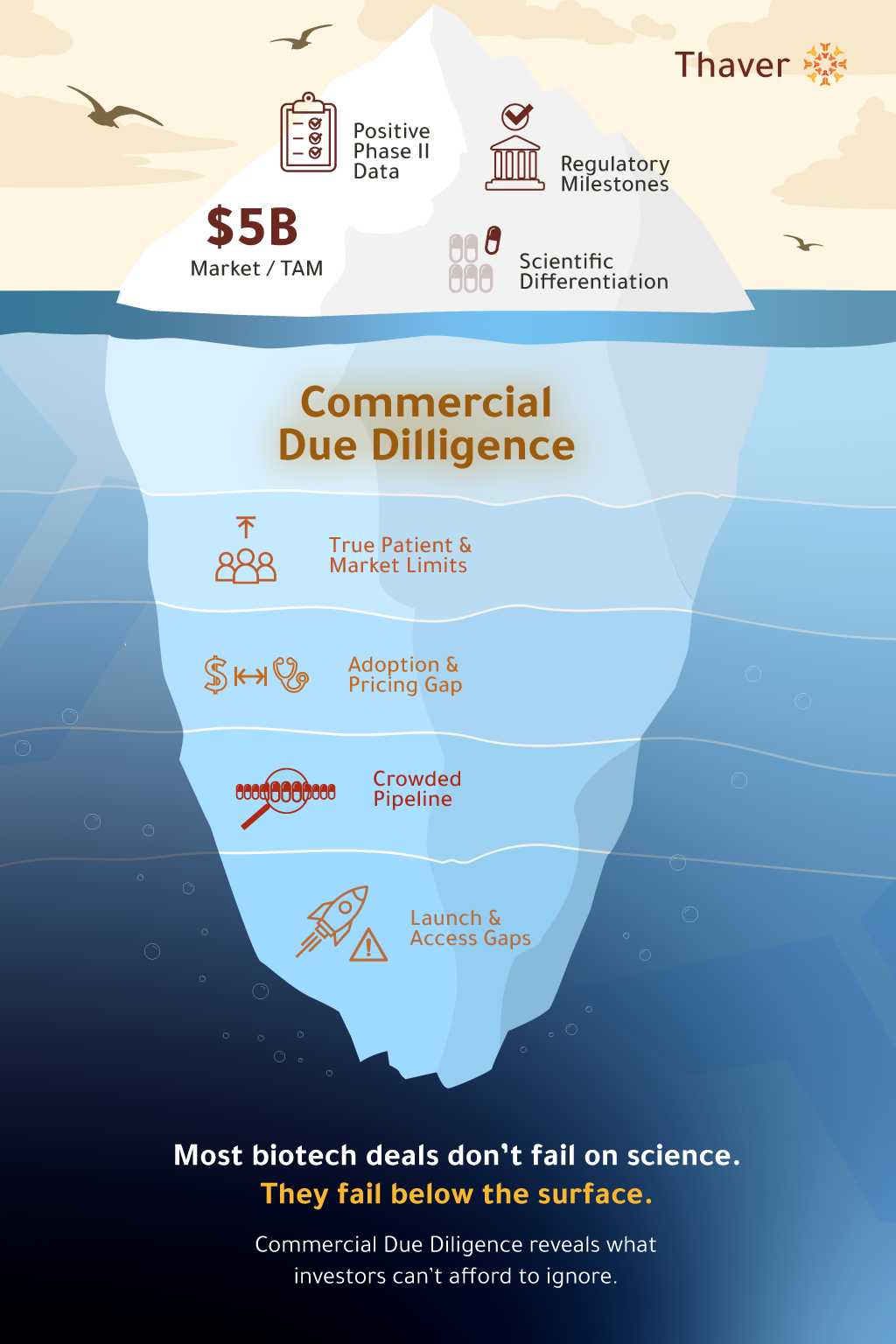

Global biotech investment has expanded rapidly over the last decade, with venture funding exceeding USD 80 – 90 billion annually at its peak and stabilizing at structurally higher levels than pre-2020 cycles. Yet despite this capital inflow, fewer than 1 in 5 biotech startups successfully transitioned from clinical promise to sustainable commercial scale. The failure is rarely scientific – it is commercial.

For corporate acquiring and private equity investors, Commercial Due Diligence (CDD) is the most critical mechanism for separating scientific potential from monetisable reality.

Why Biotech Requires a Different Commercial Lens

Unlike traditional software or industrial assets, biotech value is realised at the intersection of:

Commercial due diligence exists to validate whether these elements converge at the right time and scale to justify the investment thesis. Industry data consistently shows that 30–50% of post-transaction value erosion in biotech deals is driven by flawed market assumptions, not clinical setbacks. Common root causes include:

Core Components of High-Impact Commercial Due Diligence

Market Viability Beyond Top-Down TAM

Effective CDD replaces headline TAM figures with bottom-up, indication-specific market models grounded in epidemiology, diagnosis rates, treatment pathways, and reimbursement eligibility. A $5B market on paper often collapses to a fraction of its size when real-world constraints are applied.

Competitive and Pipeline Intelligence

With over 10,000 biotech assets currently in development globally, competitive risk is dynamic. CDD must account for:

KOL, Physician, and Payer Validation

Primary research with clinicians and payers is essential to test:

Forecasts built without payer input are structurally fragile.

Forecast and Valuation Integrity

In biotech, valuation is forecast-driven. Robust CDD stress-tests assumptions across:

This creates risk-adjusted scenarios, not optimistic narratives.

The Cost of Inadequate Commercial Due Diligence

Biotech transactions frequently close with unresolved questions around:

When commercial ambition outpaces execution capability, post-close forecast compression is inevitable, often within the first 12–18 months. This typically reflects misaligned market assumptions, pricing strategy, or launch readiness.

When done rigorously, Commercial Due Diligence goes beyond downside protection. It sharpens market positioning, informs pricing and launch sequencing, aligns capital with value-inflection milestones, and strengthens negotiation leverage while improving capital efficiency.