Market Validation as a Growth Lever for Biotech – From Hypothesis to Scalable Adoption

27 January 2026

For biotech startups, innovation alone is not enough- the industry rewards solutions that demonstrate proven value, validated demand, and clear commercial pathways. Market validation is the mechanism that turns early hypotheses into scalable, investable, and adoption-ready offerings.

Understanding these shifts helps teams identify which segments are early adopters and what outcomes they value most.

Example:

A diagnostics startup validating clinical utility across 12 NHS labs realised that microbiologists and procurement officers had completely different priorities – forcing them to create dual value propositions.

USP clarity must be tested, not assumed.

Example:

A cell therapy platform discovered through KOL interviews that oncologists valued turnaround time over cost- reshaping its USP to emphasize rapid processing.

Early interviews, KOL consultations, and message A/B tests ensure differentiation is grounded in what the market actually cares about.

Example:

A synthetic biology startup ran a 6-week pilot with two CROs to validate throughput claims and uncovered usability gaps that engineering hadn’t anticipated.

Beta testing yields insights into performance, regulatory expectations, evidence generation, and purchasing considerations.

Positioning becomes more powerful when shaped by real-world insight, not founder assumptions.

Example:

A proteomics tool company learned that its competition was not other assays – but entrenched workflows inside academic labs. Their new narrative shifted from “better assay” to “enables experiments not previously possible.”

Definitions:

Common mistakes to avoid:

Commercial Feasibility Includes:

These insights inform both product development and business model design.

Example:

A genomics startup discovered that while the TAM looked huge, only 14% of labs had budgets aligned with their pricing – drastically refining their SOM and preventing wasted GTM efforts.

Choosing the right entry point determines both traction and credibility.

Biotech Sales Motions

Because biotech purchasing is slow, complex, and evidence-driven, the sales approach must mirror that reality.

Typical early-stage motions include:

These motions help build trust and reduce perceived risk for evaluators and procurement teams.

GTM Components Informed by Validation

As insights accumulate, they shape the core GTM engine:

These elements become sharper and more commercially grounded as real-market feedback accumulates.

Example:

A lab automation startup discovered that their fastest route to scale was CRO partnerships – not selling directly to individual biotech labs – and redesigned their GTM accordingly.

Once market validation clarifies your direction, the next step is to implement it. Thaver’s Go-To-Market (GTM) Checklist for Start-ups provides a structured blueprint for launch- helping teams reduce risk, accelerate early revenue, and execute with precision.

Checklist link: https://thaver.co.uk/go-to-market-checklist-for-start-ups/

Thaver enables businesses to achieve ambitious goals by helping them make confident, data-backed decisions, assess market viability, and mitigate commercial risks.

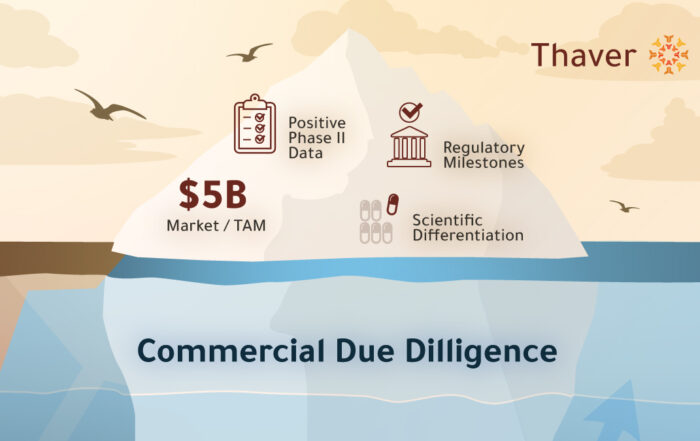

Our core offering, Commercial Due Diligence & Market Validation, provides the critical insights needed to validate assumptions, uncover true potential, and ensure your strategic moves lead to a successful outcome.

Contact us here to discuss your business.